Reducing the cost of regulatory compliance for outsource contracts, part 3

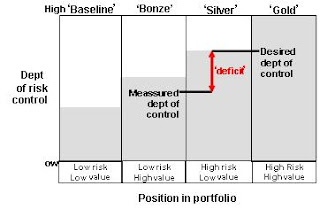

This post is the third in a row in which I write on a methodology I created to improve the effectiveness and efficiency of managing regulatory risk when outsourcing. The first two posts are here and here . Below I write on translating the risk/value ratio’s of the outsource contracts into the optimum control strategy. The starting point is the contract portfolio in which the value and compliance risk of the outsource contracts are plotted. The position drives among others the resources spend by the compliance function on monitoring a contract. The control and monitor activities are typically described in a so called Compliance Program which is the overarching framework that encompasses the different activities and responsibilities performed by the compliance function. Compliance cost can be reduced further by applying only a ´golden´ control and monitoring approach when it is really necessary (for example at high risk and value) and select a ´silver´ or ´bronze´ approach elsewhere (se