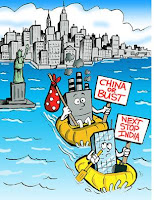

Can China and India sustain its position as an attractive destination, part 2

In this post I discussed how tolerance of a people influences the overall development of a country and thus also its attractiveness as an outsource/ captive destination. This article explores a bit the history behind the exclamations that this is the ‘Century of Asia’ and what this again means for Asia as a destination to offshore activities to. First remark regarding the exclamation is that there is no homogenous Asia. Asia is a continent and countries within it develop at different speeds. Vietnam is not China and The Philippines not Cambodia. Second remark to this is that the ‘Century of Asia’ was for the first time exclaimed in 1905 by the Japanese when they defeated the Russians in a famous naval battle. The second time the term was used was in 1911 when nationalists overthrew the Chinese Empire. After Mao kicked the nationalists out in 1956 there was another opportunity for Asia to become more prominent, but mess ups by the communist government (e.g. Great Leap Forward, cultura